Key Findings

Why Chinese tech giants are racing to improve transparency

Why Chinese tech giants are racing to improve transparency

By Jie Zhang

For years, Chinese tech giants Alibaba, Baidu, and Tencent, ranked among the least transparent companies in RDR’s evaluations. This was largely the result of their lack of disclosure on critical issues such as government requests for content removals and user data. Their governance structures and human rights commitments were also opaque, leading to their consistently low ranking in our governance category. In the 2022 RDR Big Tech Scorecard, Alibaba was the least transparent company with respect to governance.

These scores have reflected China’s tightly controlled internet environment, with laws and censorship regulations requiring tech companies to comply with government requests for data access and content restriction.

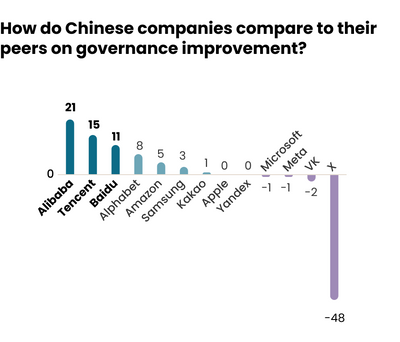

In the RDR 2025 Index, a major shift occurred—Alibaba, Tencent, and Baidu scored the largest improvements in governance transparency out of all the companies evaluated.

Alibaba saw the most dramatic leap, with a boost in its governance transparency by an impressive 21 points, followed by Tencent with nearly 15 points, and Baidu with an 11-point improvement.

Notably, Tencent and Alibaba both made first-time human rights commitments. With respect to governance, all three companies provided greater transparency on their top-down oversight mechanisms, outlining how they monitor ESG practices, including around human rights issues.

Beyond structural disclosures, these companies also offered more insight into the human rights impact assessments they carry out. Alibaba stated that it “regularly review[s] data privacy risks related to human rights.” Meanwhile, Baidu disclosed that it collaborates with “third-party human rights experts to conduct company-wide due diligence, identifying and mitigating potential risks” in its operations and value chain.

These sudden improvements signal a growing recognition among Chinese tech firms of the need for greater transparency and accountability in governance. But what has sparked such a dramatic leap?

Rather than marking a voluntary commitment to accountability in light of growing risks associated with tech, these improvements reflect a strategic response to mounting external pressures—driven by both market forces and shifting geopolitical dynamics.

International Investor Confidence Is Crumbling

Despite their dominance in China, Alibaba, Tencent, and Baidu have long relied on foreign capital to fuel their growth. During the golden era of U.S.-China economic relations, all three companies tapped into U.S. stock markets, becoming some of the most sought-after tech stocks among Western investors.

Baidu was the first to go public, debuting on the Nasdaq in August 2005, and later securing a secondary listing on the Hong Kong Stock Exchange in March 2021. Alibaba took a similar path, dual-listing on the New York Stock Exchange and the Hong Kong Stock Exchange. While Tencent is primarily listed in Hong Kong, it has also issued American Depositary Receipts (ADRs) in the U.S., allowing American investors to access its shares.

For years, these Chinese tech stocks enjoyed strong demand from global investors. However, in recent years, that landscape has shifted dramatically. Beginning in 2021, Chinese tech stocks started to plummet in overseas markets, due to a mix of geopolitical tensions, regulatory crackdowns, and economic uncertainty.

This pressure came from different directions. Beginning in 2020, the Chinese government initiated a sweeping crackdown on the tech sector, as President Xi Jinping sought to rein in what he viewed as the “disorderly” expansion of capital by the industry. This aggressive regulatory push rattled investors, raising concerns about long-term domestic risks and dampening confidence in China’s once-thriving tech giants. The measures deployed by Beijing included an IPO suspension for Ant Group, a sister company of Alibaba under the control of billionaire businessman Jack Ma. They also meant rolling out a series of new laws and regulations related to the internet and data security, imposing antitrust fines, punishing reckless overseas IPOs, introducing golden shares to secure greater state influence over tech firms, as well as restricting online gaming.

Meanwhile, China’s post-pandemic economic slowdown made it more difficult for tech companies to sustain the kind of growth that once attracted global investors. The prolonged crackdown and economic uncertainty eroded market confidence. In August 2023, by the time the Chinese government had officially ended these actions, China’s major tech companies had lost more than USD 1 trillion in market value—equivalent to the entire Dutch economy.

At the same time, outside of China, tensions between Beijing and Washington led to increasing restrictions on Chinese firms operating in the U.S. market. For example, on December 2, 2021, the U.S. Securities Exchange Commission (SEC) finalized rules demanding complete access to the books of U.S-listed Chinese companies, and threatened to delist those who failed to meet their compliance requirements. Although Chinese tech companies survived, their market capital dropped sharply.

Amid China’s post-pandemic economic slowdown and ongoing U.S.-China tensions, several rating agencies downgraded Chinese tech firms, as well as the country itself. In 2022, Sustainalytics, an ESG rating agency, downgraded several Chinese tech giants, including Tencent and Baidu, citing their role in China’s internet censorship regime. Shortly after, Morgan Stanley followed suit, lowering Alibaba and Baidu’s rating from “overweight” to “equal-weight.”[1] These downgrades continued to shake investor confidence in Chinese tech. For instance, dozens of ESG investors sold more than USD 1 billion worth of Tencent shares following its downgrade by Sustainalytics.

Chinese tech companies, including Alibaba, Baidu, and Tencent, had long thrived on foreign investment. As global investors grew wary of the risks tied to China’s regulatory landscape, these firms faced mounting pressure to restore confidence and maintain investor engagement.

For institutional investors, strong governance disclosures and sustainability performance are key indicators of corporate stability and long-term viability. Recognizing this, Chinese tech companies began to align their policies and practices more closely with international sustainability standards, while improving their governance disclosures. Notably, Alibaba and Baidu also actively engaged with RDR for the first time this year, offering feedback on the RDR evaluation —something they had never done before.

Market Pressure Drives Change

The dramatic improvements in governance transparency by Alibaba, Tencent, and Baidu highlight a fundamental truth about corporate behavior: Companies are more responsive to market pressure than ideals. Companies increase their transparency when external forces—whether investors, regulators, or fear of reputational risks—make it necessary. The Chinese tech giants’ response to sustainability concerns serves as a clear example of how market incentives can drive real improvements in governance.

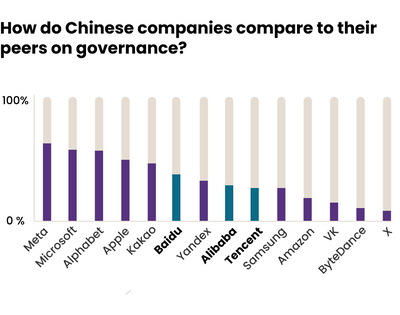

That said, while Chinese companies made significant strides in their transparency on governance this year, their overall transparency in this area still lagged behind most U.S. companies. For example, Chinese companies still revealed limited information about the scope and details of their human rights risk assessments and shared no substantial information about how they engage with civil society on users’ rights. Their progress this year was largely a catch-up from a historically low baseline rather than a leap ahead. Despite the improvements, Chinese companies still have a long way to go.

The global sustainability landscape is also shifting, with increasing pushback in both the U.S. and Europe that could have long-term implications for corporate transparency. In the U.S., this remains a highly politicized issue, with multiple red states recently passing anti-ESG bills, and the new Trump administration taking a more hostile stance on ESG-driven investments. In Europe, the European Commission has signaled plans to ease corporate sustainability reporting requirements, with the aim of remaining competitive with the U.S. and China.

As global sustainability momentum weakens, the future of corporate transparency—especially for tech companies—remains uncertain. The recent progress made by Chinese firms may be tested in an evolving market landscape where incentives for transparency have shifted. Important questions, therefore, still linger: Will these companies continue on the path toward greater transparency, embedding these governance improvements into their long-term corporate strategy? Or are these efforts merely a short-term response to investor pressure?