Key Findings

Private platforms are falling short on transparent governance

Private platforms are falling short on transparent governance

By Jie Zhang

It is common practice for publicly listed companies to disclose their financial statements, governance structures, risk factors, and major business developments through annual reports, U.S. Securities and Exchange Commission (SEC) filings, and investor communications. These companies are also increasingly reporting on sustainability metrics—driven by a shifting regulatory environment, investor expectations, public scrutiny, and global frameworks. For example, Australia recently introduced new guidelines requiring publicly listed companies to produce sustainability reports.

Such sustainability disclosures play a critical role in corporate accountability by providing measurable insights into how companies identify, manage, and mitigate non-financial risks, and how they meet stakeholders’ expectations.

However, unlike publicly traded firms, private companies are not subject to the same disclosure expectations and typically operate with far less transparency. Without the pressure to court public investors or comply with stock market regulations, unlisted firms face fewer demands to disclose their governance structure and practices. Many also lack the internal infrastructure or incentive to pursue voluntary sustainability and impact reporting.

Yet, some of the most powerful tech companies today—like ByteDance, the parent company of TikTok; X, formerly Twitter; Huawei; and OpenAI—are currently privately held.

For the first time this year, RDR evaluated unlisted tech giants, including TikTok and X. Although Twitter has been evaluated by RDR since 2015, it became privately held after Elon Musk acquired and delisted the company in 2022.

We wanted to know: Does private ownership affect companies’ transparency on governance, risks, and corporate responsibility?

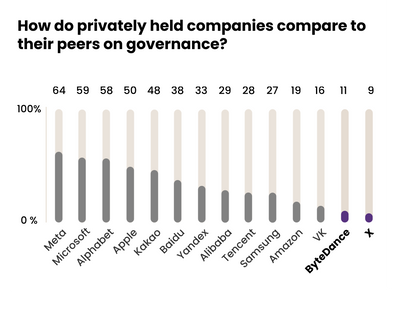

We found that TikTok and X demonstrated comparable transparency to other U.S.-based platforms on policies and practices protecting freedom of expression and privacy. However, both fell short of other assessed companies in disclosing their governance processes, raising serious concerns about accountability, oversight, and how decisions involving content moderation, data security, and the broader societal impacts of their algorithms and platform governance are made.

X: A Transparency Retreat Under the Private Ownership of Elon Musk

Transparency at X declined sharply following Elon Musk’s takeover. While the platform maintained a human rights commitment, the company operating it—X Corp.—did not pledge to uphold human rights at the organizational level. Neither did X Holdings Corp.[1] the parent entity controlling X Corp.

In 2021, before the acquisition, Twitter released a Global Impact Report, highlighting its efforts to address key issues relevant to sustainability and social impacts. The report included information on corporate governance structures and oversight mechanisms for freedom of expression and privacy, as well as assessments of privacy risks. After Musk’s takeover, however, the publication of such reports ceased.

Meanwhile, governance-related web pages that once offered insights into the company’s civic engagement and stakeholder consultation were removed or left outdated. For example, Twitter previously had a Civic Engagement web page, which shared information about how the company engaged with stakeholders. However, the page no longer exists following Elon Musk’s move, at the end of 2022, to dissolve the company’s Trust and Safety Council. This advisory group of civil society experts was formed in 2016 to address problems including hate speech, child exploitation, and self-harm on the platform.

Transparency reporting at X has also suffered. Previously, Twitter published regular biannual transparency reports detailing platform content moderation and government takedown requests. X paused this practice for around two years before releasing its first transparency report under Musk in September 2024. The report, released amid growing public concern that the platform had become less safe under new ownership, was notably less detailed.

TikTok: Human Rights Claims Without Structural Transparency

Like X, TikTok’s parent company, ByteDance, is also unlisted. Also similar to X, a lack of disclosure on governance practices, both at the parent company level as well as for its platform TikTok, resulted in a low score for the company in this category. While TikTok itself has pledged to respect human rights, ByteDance has made no corresponding public commitment. In contrast, other Chinese tech giants evaluated by RDR—Alibaba, Baidu, and Tencent—are publicly listed and have all included human rights commitments in their corporate governance disclosures, even though they face the same political environment as ByteDance.

Neither ByteDance nor TikTok, which has declared that it operates independently from ByteDance, released any impact or sustainability report. Despite TikTok’s human rights commitment, the lack of disclosure on an oversight mechanism by either TikTok or ByteDance, makes it difficult to understand how the platform upholds this commitment internally. ByteDance also shared no information about how it engages with stakeholders.

Finally, while TikTok revealed that it conducts human rights assessments, it provided no relevant details on its website. Meanwhile, ByteDance shared no information about whether it carries out any human rights risk assessments at the parent company level.

Public Impact Demands More Transparency from Private Tech Firms

The lack of sustainability and accountability reporting from companies such as X and TikTok illustrates how private ownership can lead to an erosion in transparency and public trust. Despite being unlisted, large tech companies play an incredibly influential role in shaping public discourse and managing vast volumes of personal data, raising urgent concerns about accountability and transparency. While X serves as a global platform for political figures, journalists, and opinion leaders, TikTok reaches over a billion users—particularly younger demographics. These platforms significantly impact how information is shared and consumed. Their societal impact is on par with, or even greater than, many publicly listed companies.

Although both TikTok and X shared some information related to sustainability issues, their disclosures were fragmented and failed to meet the standards expected of companies with such massive social influence. Given their scale, there is a pressing need to extend sustainability disclosure expectations to such companies—particularly on governance structure, risk assessment, data management, content moderation, and the use and development of AI. This will help the public, investors, and regulators assess how these platforms operate—and hold them to account.

Though for different reasons, both TikTok and X are facing crises of trust in the U.S. TikTok has come under intense scrutiny over national security concerns due to its ownership by Chinese tech firm ByteDance, prompting legislation that could force a divestment. Meanwhile, X has struggled with public trust since Elon Musk’s takeover, facing a backlash over weakened content moderation, the disbanding of its Trust and Safety Council, and a rise in misinformation. As a result, many advertisers have fled from X. Systematic corporate governance and sustainability disclosures and greater transparency can play a vital role in rebuilding trust.

Over the past decade, sustainability disclosures have gained significant momentum globally. As early as 2019, Nasdaq introduced a new voluntary ESG Reporting Guide applicable to both publicly listed and private companies. Mandatory sustainability reporting for large private firms is already on the horizon in some jurisdictions. The European Commission’s Corporate Sustainability Reporting Directive (CSRD) requires companies—both public and private—that operate in the EU to report on sustainability performance and have their disclosures independently audited. While recent adjustments to CSRD have eased requirements for smaller private firms, companies of the size and influence of X and TikTok will still be expected to comply.[2]

Meanwhile, as of April 6, 2022, over 1,300 of the largest UK-registered companies and financial institutions, including private ones, will be required by law to disclose climate-related financial information. In recent years, the U.S. Securities and Exchange Commission (SEC) has also sought to promote greater transparency among large private companies. The U.S. is, of course, experiencing a notable backlash against ESG agendas. Nevertheless, the broader global business and regulatory environment is increasingly demanding greater transparency and accountability, and more companies have begun reporting on these matters.

To meet their obligations under the EU’s Digital Services Act, TikTok and X submitted risk and transparency reports for 2023 and 2024, but they only covered their operations in the European market. These efforts are a start, but their scope needs to expand significantly to match their global footprint.

Beyond simply succumbing to regulatory pressure, disclosures on corporate governance and impacts can bring tangible benefits to private companies. They help support better internal decision-making, risk management, and long-term sustainability. Finally, they position companies to better attract responsible capital, forge trusted partnerships, and stay ahead of public expectations in an increasingly values-driven market.

In an era where private tech companies wield unprecedented influence over public discourse, personal data, and even democratic institutions, transparency and accountability can no longer be optional. Large private companies like TikTok (ByteDance) and X, as well as major emerging players like Open AI, shape how billions communicate and access information. Yet their internal practices often remain opaque. Sustainability disclosures offer a practical path toward building public trust, improving governance, and aligning with global expectations on corporate responsibility, even if not currently mandated by market regulators. Private tech companies must be held to account through regulatory scrutiny, and, at the same time, should proactively adopt transparent practices that reflect the scale of their societal impact.

Footnotes

[1]On March 28, 2025, Elon Musk announced, via a post on X, that he had sold the X platform to xAI, his own artificial intelligence startup, in a deal valued at USD 33 billion.

[2]Under the proposed EU Omnibus Package, only non-EU parent companies with over €450 million in EU turnover and either a large EU subsidiary (defined by EU turnover and employees) or an EU branch with €50 million in turnover will be required to report under the CSRD.